players99.site Gainers & Losers

Gainers & Losers

Publish A Video

To publish a video to a social media site, follow these steps. Do one of the following: Click on a video to open the video details page and click Publish to. You can upload videos to YouTube in a few easy steps. Use the instructions below to upload your videos from a computer or from a mobile device. there's an option to publish your video on a later date/time. it's on the fourth tab after you upload (after the video check). another option is. Checkmark the My Media video you want to publish to your Media Gallery, then click Publish. This adds the video to your Media Gallery. Students can then click. This is what I do. Set the video to publish a few hours later - gives everything time to be encoded in all the resolutions. To publish a video to a social media site, follow these steps. Do one of the following: Click on a video to open the video details page and click Publish to. When you upload a video, the video file is imported to YouTube. When you publish a video, the video is made available for anyone with access to watch it. To publish a video you have to click the Publish button in top right corner. Once clicked you have 3 ways to upload a video. I always allow at least 3 hours to let the video process of I'm uploading and publishing the same day. Normally I have it uploaded the day. To publish a video to a social media site, follow these steps. Do one of the following: Click on a video to open the video details page and click Publish to. You can upload videos to YouTube in a few easy steps. Use the instructions below to upload your videos from a computer or from a mobile device. there's an option to publish your video on a later date/time. it's on the fourth tab after you upload (after the video check). another option is. Checkmark the My Media video you want to publish to your Media Gallery, then click Publish. This adds the video to your Media Gallery. Students can then click. This is what I do. Set the video to publish a few hours later - gives everything time to be encoded in all the resolutions. To publish a video to a social media site, follow these steps. Do one of the following: Click on a video to open the video details page and click Publish to. When you upload a video, the video file is imported to YouTube. When you publish a video, the video is made available for anyone with access to watch it. To publish a video you have to click the Publish button in top right corner. Once clicked you have 3 ways to upload a video. I always allow at least 3 hours to let the video process of I'm uploading and publishing the same day. Normally I have it uploaded the day.

This article covers the steps and guidelines on how to use these publishing capabilities to create best performing content on YouTube. Learn how to publish your video as a 'Public' video so that it is searchable on the internet by anyone. You can now share your video to any platform or person. Upload videos · Open the YouTube app. · Tap Create and then Video. · Select the file you'd like to upload and tap NEXT. If your video is 60 seconds or less and. Select the downward arrow beside the Share button in the upper right corner of the video settings page and then select Publish > Publish to social. How to publish your videos to social · Log in to your Vimeo account, then go to your Library. · Once there, select the video you want to share to a social. When you upload a video, the video file is imported to YouTube. When you publish a video, the video is made available for anyone with access to watch it. Technical note: Agorapulse doesn't modify uploaded video file(s) in any way - we take the video the user has uploaded and send it (upload) using the respective. Learn how to publish your video as a 'Public' video so that it is searchable on the internet by anyone. You can now share your video to any platform or person. You can only upload video episodes on Spotify for Podcasters web. You can upload and save a draft video episode on the web and then use the mobile app to. Kaltura is the cloud-based video management system behind My Media and Media Gallery, which are Canvas LTI tools. The publishing option in Synthesia, allows you to share your generated videos with others. To share content, A menu will open giving you two options. Descript lets you publish videos directly to your YouTube channels. Hobysist and Free plans may publish videos up to 1 hour. Creator. Publish a video to YouTube · Go to your video library and click on the Title of the video you would like to publish to YouTube. · Scroll down to the ”Publish”-. CreateStudio lets you publish videos with up to 4K resolution. It also has preset video formats for different social media platforms. In this topic you will learn how to publish videos and playlists using the Media module. This topic contains information on publishing videos and playlists to. To publish your video, simply select 'Publish' from the menu on the right side of the Mindstamp editor. If you merely publish the same video to each location, it's worth the test. You're likely to have a completely different audience on Pinterest. Upload your video in seconds on Streamable. We accept a variety of video formats including MP4, MOV, AVI, and more. It's free, try it now! By default, any media you upload is private. To share it with others, you'll need to publish it in a channel or gallery on your Video Portal. In addition to uploading video files directly into your digital experiences, you can add videos from YouTube or Vimeo channels with just the URL. No need to.

Cost Of Weightloss Surgery

The most important is whether your health insurance plan covers weight loss surgery. If your insurance does not cover the cost and you're paying for the surgery. Weight loss surgery is expensive, with the average cost of a gastric bypass ranging from $18, to $22,, and the cost of adjustable gastric banding. The often quoted surgery cost of gastric bypass is $23, During this procedure, the weight loss surgeon makes the stomach smaller and rearrange the small. The average cost of gastric bypass surgery in the United States ranges from $20, to $35, This can vary depending on factors such as the. Situation #1: No Health Insurance Coverage (cash pay) · Laparoscopic Adjustable Gastric Band (LAGB)- $8, · Laparoscopic Roux-en-Y Gastric Bypass (LRnYGB) –. Your insurance company may cover the costs of weight-loss surgery. Your team will need to show that the procedure is medically necessary. Also, you may need to. According to nationwide averages, a gastric bypass procedure costs around $23,, while a gastric sleeve procedure costs around $15, These costs include. Tijuana Bariatrics offers low-cost bariatric surgery to help patients affordably lose significant amounts of weight. With a large network of doctors. The average estimated cost of gastric sleeve surgery or sleeve gastrectomy in the US between $ and $ Most major insurance companies cover. The most important is whether your health insurance plan covers weight loss surgery. If your insurance does not cover the cost and you're paying for the surgery. Weight loss surgery is expensive, with the average cost of a gastric bypass ranging from $18, to $22,, and the cost of adjustable gastric banding. The often quoted surgery cost of gastric bypass is $23, During this procedure, the weight loss surgeon makes the stomach smaller and rearrange the small. The average cost of gastric bypass surgery in the United States ranges from $20, to $35, This can vary depending on factors such as the. Situation #1: No Health Insurance Coverage (cash pay) · Laparoscopic Adjustable Gastric Band (LAGB)- $8, · Laparoscopic Roux-en-Y Gastric Bypass (LRnYGB) –. Your insurance company may cover the costs of weight-loss surgery. Your team will need to show that the procedure is medically necessary. Also, you may need to. According to nationwide averages, a gastric bypass procedure costs around $23,, while a gastric sleeve procedure costs around $15, These costs include. Tijuana Bariatrics offers low-cost bariatric surgery to help patients affordably lose significant amounts of weight. With a large network of doctors. The average estimated cost of gastric sleeve surgery or sleeve gastrectomy in the US between $ and $ Most major insurance companies cover.

Of the three main types of weight loss surgery, gastric bypass surgery is typically the most expensive option, with an average cost of approximately $23, A. , Bariatric Surgery – Gastric Sleeve, $4, ; , Bariatric Surgery – Duodenal Switch, $8, ; , Bariatric Surgery – Gastric Bypass Revision. The cost for gastric sleeve surgery with Dr. Thomas Borland is $11, This is less than the national average of $16, and less than the $15, average in. If you are looking to start a healthier life, don't let costs hold you back! We are committed to helping you through financial aspects of bariatric surgery. The average cost of gastric sleeve surgery without insurance ranges from $ to $, with an average cost of $ Learn more. For all cash pricing, certain medical criteria apply. **To determine if you meet criteria for bariatric surgery, make an appointment to be seen in our office. According to the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), the cost of weight loss surgery as of was in the range of. What does bariatric surgery cost? Weight loss surgery costs between $15, and $25,, depending on the procedure you choose. The average cost of gastric. Package Pricing for Self Pay Patients: · Vertical Sleeve Gastrectomy: $9, · Laparoscopic Gastric Banding: $9, · Roux En Y Gastric Bypass: $14, · Endoscopic. For a limited time, The University of Kansas Health System is offering the best, lowest price for weight loss surgery in Kansas City. Weight Loss Surgery Costs: Self-Pay ; Program fee, $, $ ; Physician consultation, $, $ ; Nutrition counseling, $, $ ; Surgeon, $3,, $3, OUR ALL INCLUSIVE WEIGHT LOSS SURGERY PACKAGE · -Vertical Sleeve Gastrectomy (VSG) Surgery $8, USD (Special Price until Sep 30, ) · -Gastric Band to. Learn how bariatric surgery coverage works with Medicare. Know if gastric bypass surgery & laparoscopic banding surgery costs are covered. $2, to $9, Out-of Pocket costs. 6. $10, or more Out-of Pocket costs. Voting closed. High-Quality Medical Care · BORDER BARIATRICS GASTRIC BYPASS $8, · AVERAGE US PRICE FOR GASTRIC BYPASS IS $27, · Gastric Sleeve · Gastric Bypass. $8, What's the average cost of bariatric surgery? Weight-loss surgery costs typically range from $7, to $33, before insurance coverage. Your total expense. The cost for gastric sleeve surgery with Dr. Thomas Borland is $11, This is less than the national average of $16, and less than the $15, average in. By paying for this procedure out of pocket, you avoid the lengthy physician-supervised diet required by most insurance companies, which is usually 7 months. Gastric Bypass Surgery Cost. To answer that question, the cost of gastric bypass surgery generally starts at $15, when paying out-of-pocket. For those opting.

Is Mutual Of Omaha A Good Company For Medicare Supplement

More Details · Are good for people who would rather pay higher premiums in exchange for lower costs when they do see a doctor · Help cover the remaining portion. Mutual of Omaha Medicare Supplement reviews are generally positive, reflecting the company's commitment to customer service and efficient claims processing. Mutual of Omaha Insurance Company and United of Omaha Life Insurance Company have earned strong ratings from three major rating services. plan on no medical bills but good luck on that. iha help • 6 years ago. We With so many people over-weight why would insurance companies not include. You're within your 6-month Medigap open enrollment period, or; You're eligible under a specific situation or guaranteed issue right (when an insurance company. Underwriting Company, Mutual of Omaha Life Insurance Company ; Medigap Plans Offered, Plan F & Plan G in all states – other plans vary by state ; Ratings, AM Best. Both A.M. Best and Standard & Poor's gave Mutual of Omaha a rating of A+. As of , they were ranked 5th largest out of 18 top life insurance companies in the. They offer good service and they pay quickly. Just know that over time, you will be paying a lot more premium than from other companies for the. Learn more about the Medicare Supplement Insurance Plans offered by Mutual of Omaha. Compare our most popular plans. More Details · Are good for people who would rather pay higher premiums in exchange for lower costs when they do see a doctor · Help cover the remaining portion. Mutual of Omaha Medicare Supplement reviews are generally positive, reflecting the company's commitment to customer service and efficient claims processing. Mutual of Omaha Insurance Company and United of Omaha Life Insurance Company have earned strong ratings from three major rating services. plan on no medical bills but good luck on that. iha help • 6 years ago. We With so many people over-weight why would insurance companies not include. You're within your 6-month Medigap open enrollment period, or; You're eligible under a specific situation or guaranteed issue right (when an insurance company. Underwriting Company, Mutual of Omaha Life Insurance Company ; Medigap Plans Offered, Plan F & Plan G in all states – other plans vary by state ; Ratings, AM Best. Both A.M. Best and Standard & Poor's gave Mutual of Omaha a rating of A+. As of , they were ranked 5th largest out of 18 top life insurance companies in the. They offer good service and they pay quickly. Just know that over time, you will be paying a lot more premium than from other companies for the. Learn more about the Medicare Supplement Insurance Plans offered by Mutual of Omaha. Compare our most popular plans.

Get a quote for Health Insurance Supplement Plans for Medicare from Mutual of Omaha. Our licensed agents can answer your questions and help you get started. The company's long history of continued growth and consistent high scores awarded by major financial rating companies, such as Moody's and A.M. Best, speak to. Agents who sell Mutual of Omaha's Medicare Supplement plans can benefit from competitive commission structures, the company's reputable image, and the expanding. The Better Business Bureau gives the Mutual of Omaha family of companies an A+ rating with only complaints in the last three years. The majority of these. Best Medigap High-Deductible Plan G Provider: Mutual of Omaha · Ratings: A+ from AM Best · Discounts: Discounts on vision, hearing, and healthy living products. The Medigap plans are standardized across companies as far as coverage goes. Mutual of Omaha gets our recommendation for Medigap plans because the company. Should you choose Mutual of Omaha, or one of its subsidiaries, such as United World Life Insurance Company or Omaha Supplemental Insurance Company, for your. United World customers give us an average overall rating of out of five stars, and more than two out of every three policy holders give us a perfect five-. Our Mutual Of Omaha Medicare supplement review is overall a strong recommendation. The Medicare Plan G is the most popular plan offered by Mutual, mostly. Plan G is the best value Medicare Supplement plan while Plan F is by far the most popular Medicare Supplement plan in Texas, with over 70% of all Texans. Mutual of Omaha has earned an A (Superior) rating from A.M. Best Company for overall financial strength and ability to meet ongoing obligations to policyholders. Is United World a Good Medicare Supplement Insurance Company? United World has served Medicare supplement insurance policyholders for years. United World. Omaha Insurance Company is a subsidiary of Mutual of Omaha. It has an A.M. Best and S&P Rating of A+ (Superior). Get our take on this Medicare carrier. Mutual of Omaha Insurance Company offers Medicare Supplement Insurance plans that help cover Original Medicare out-of-pocket costs. Mutual of Omaha has a long history of providing quality service to its customers. Mutual of Omaha has lowered their Medicare Supplement Rates for ! For a. As an independent insurance agency, I offer many highly reputable companies in the Medicare Market. One of those being Mutual of Omaha. Mutual of Omaha. Company Explanation: United World Life Insurance is a subsidiary of the Mutual of Omaha. Non-tobacco rates. USAA Life Insurance Company. Customer Service Phone. Mutual of Omaha enjoys an A+ rating from AM Best, which rates the financial stability of insurance companies. This is the highest available financial rating for. Wellcare currently provides quality, affordable healthcare to more than million Medicare Advantage members in 36 states and is the second largest.

How Hard Is It To Get A Mortgage In 2021

Getting a conventional loan with bad credit can be difficult. To have any chance, you'll need to find a flexible lender and be ready to offer a large down. These rising rates make it more expensive to borrow money which means fewer potential buyers can afford mortgages. If you take out a two-year fixed-rate. You have at least a credit score · You can make a down payment between 3% and 20% · You want a loan with mortgage insurance that you can get rid of as you. You may be required to make a larger down payment for a second home, and a second mortgage will probably have a higher interest rate. Guidelines will vary from. Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to. This means that monthly payments on the line of credit can fluctuate, which can make budgeting and planning difficult. is licensed as mortgage lender # It's hard to get a mortgage nowadays. The lending market is incredibly tight and only borrowers with the best credit are getting the best rates. Call your mortgage servicer as soon as you know you can't make your monthly payment. Or, if they have tried to reach you, make sure to accept calls from your. get Adjustable Rate Mortgages is one of the all-time great financial moves. It's hard to see mortgage rates getting back to those levels again. Getting a conventional loan with bad credit can be difficult. To have any chance, you'll need to find a flexible lender and be ready to offer a large down. These rising rates make it more expensive to borrow money which means fewer potential buyers can afford mortgages. If you take out a two-year fixed-rate. You have at least a credit score · You can make a down payment between 3% and 20% · You want a loan with mortgage insurance that you can get rid of as you. You may be required to make a larger down payment for a second home, and a second mortgage will probably have a higher interest rate. Guidelines will vary from. Lenders look at your income, employment history, savings and monthly debt payments, and other financial obligations to make sure you have the means to. This means that monthly payments on the line of credit can fluctuate, which can make budgeting and planning difficult. is licensed as mortgage lender # It's hard to get a mortgage nowadays. The lending market is incredibly tight and only borrowers with the best credit are getting the best rates. Call your mortgage servicer as soon as you know you can't make your monthly payment. Or, if they have tried to reach you, make sure to accept calls from your. get Adjustable Rate Mortgages is one of the all-time great financial moves. It's hard to see mortgage rates getting back to those levels again.

Not only does it increase your debt to income ratio, but even hard credit inquiries can put a ding on your credit report and reduce your score. Wait until after. Updated: Jun 1, , am. Editorial Note: We earn a more difficult to get approval on a mortgage. A lender will typically grade your score in the. Qualifying for a mortgage is based on several factors, including how much you're looking to borrow, your credit history, the size of your down payment, debt-to-. As you ponder your future and the possibility of buying your own home, it will be helpful to start thinking early on about how to make it happen. Start by. There is no minimum credit score requirement. Debt-to-income ratio. Homeowners have a more generous 65% DTI ratio, compared with the 45% maximum that comes with. August 4, The Complete List of HUD Loan Requirements. HUD loans are popular because of their attractive interest rates Anyone who meets FHA loan. What is a non-recourse loan? Who are the lenders? What does it take to qualify? These are just some of the questions we get asked. From your mortgage. Getting a conventional loan with bad credit can be difficult. To have any chance, you'll need to find a flexible lender and be ready to offer a large down. These SBA-backed loans make it easier for small businesses to get the funding they need. To get an SBA-backed loan: Read on to see the kinds of loans available. Also, a foreclosure will cause a significant decline in your credit scores, making it more difficult to get a new mortgage. Updated October 15, They also look for any negative items in your credit history that could automatically disqualify you from getting a mortgage loan. If you are building your. They're usually higher than home mortgage loans, but don't let that deter you from getting one. Credit unions will typically offer lower interest rates for. Standard loan programs allow borrowers who've emerged from bankruptcy to get a mortgage approval after completing a waiting period and meeting other eligibility. strong purchasing power of the Canadian dollar. However, with a lower Loonie Accordingly, you'll need to get a mortgage from a lender in the U.S. The American Rescue Plan Act of established the Homeowner If owed for less than 3 months, Mortgage Reinstatement doesn't apply and the. The main obstacle to getting any mortgage is proving to the lender that you fit its risk profile. That means providing your employment history, credit history. The advantages are hard to put a price on – this will be your home base for get started with your Reverse Mortgage. What is your full name?*. First. Get a copy of your credit report. Your credit report works the same way your school report card did—the higher, the better. If you have a higher score, you'll. mortgage or property tax payments or who have partial claims/loan deferrals due to pandemic-related financial hardships can get a fresh start. The grants. FCTD has originated mortgages for real estate investors since its founding in , with an emphasis on hard money lending for investment projects. But, over.

Ada Spot Price

The current Cardano price is $ In the last 24 hours Cardano price moved +%. The current ADA to USD conversion rate is $ per ADA. The circulating. Cardano Market Cap. The current Market Cap ranking of ADA is #12, with a live market cap of $12,,, What is the Cardano all time high? Cardano hit. Cardano's price today is US$, with a hour trading volume of $ M. ADA is +% in the last 24 hours. It is currently % from its 7-day all-. What would the price of Cardano (ADA) be if it had the market cap of Bitcoin (BTC)? See live prices and stats for stocks and cryptocurrencies. The live price of Cardano is $ per ADA/USD, with a current market cap of $12,,, USD. The hour trading volume is $3,, USD. The. - The live price of Cardano is $ per (ADA/USD). View Cardano live charts, ADA market information, and ADA news. The price of Cardano (ADA) is $ today, as of Sep 11 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. Convert Cardano to US Dollar (ADA to USD). The price of converting 1 Cardano (ADA) to USD is $ today. ADA. The current price of Cardano (ADA) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what coins. The current Cardano price is $ In the last 24 hours Cardano price moved +%. The current ADA to USD conversion rate is $ per ADA. The circulating. Cardano Market Cap. The current Market Cap ranking of ADA is #12, with a live market cap of $12,,, What is the Cardano all time high? Cardano hit. Cardano's price today is US$, with a hour trading volume of $ M. ADA is +% in the last 24 hours. It is currently % from its 7-day all-. What would the price of Cardano (ADA) be if it had the market cap of Bitcoin (BTC)? See live prices and stats for stocks and cryptocurrencies. The live price of Cardano is $ per ADA/USD, with a current market cap of $12,,, USD. The hour trading volume is $3,, USD. The. - The live price of Cardano is $ per (ADA/USD). View Cardano live charts, ADA market information, and ADA news. The price of Cardano (ADA) is $ today, as of Sep 11 a.m., with a hour trading volume of $M. Over the last 24 hours, the price has. Convert Cardano to US Dollar (ADA to USD). The price of converting 1 Cardano (ADA) to USD is $ today. ADA. The current price of Cardano (ADA) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what coins.

The current real time Cardano price is $, and its trading volume is $,, in the last 24 hours. ADA price has plummeted by % in the last day. Cardano (ADA) has a market cap of $ and a live price of $ Check more stats and compare it to other stocks and crypto. The Cardano ADA coin has a maximum supply of 45 billion. When talking about either the ADA Cardano price, Cardano ADA price, Cardano price today or the price of. Track current Cardano prices in real-time with historical ADA USD charts, liquidity, and volume. Get top exchanges, markets, and more. Find the latest Cardano USD (ADA-USD) stock quote, history, news and other vital information to help you with your stock trading and investing. Cardano ADA ; 24 high · ; 24 low · ; 24 volume. $ M ; # Coins. B ; Market cap. $ B. Asset. asset image, ada logo. Cardano ; Metric. Price & Volume ; Market. Spot ; Exchange. All Exchanges ; Resolution. Day. Track Cardano price today, explore live ADA price chart, Cardano market cap, and learn more about Cardano cryptocurrency. We update our ADA to USD price in real How Has Cardano's Price History Shaped Its Position in the Cryptocurrency Market? Cardano USD (ADA-USD) ; Aug 21, , , , , ; Aug 20, , , , , Cardano (ADA) prices - Nasdaq offers cryptocurrency prices & market activity data for US and global markets. The live Cardano price today is $ with a hour trading volume of $M. The table above accurately updates our ADA price in real time. And the lowest recorded ADA price is €. How do Cardano price movements correlate with market trends? Check our complete cryptocurrency exchange rate. Cardano's hour trading volume is USD M. Cardano is currently #11 by market capitalization, which is calculated by multiplying the current price (USD. Live Cardano price today is $ USD and ADA hour trading volume is $ USD. Track the latest ADA price, market cap, trading volume. The current price is $ per ADA with a hour trading volume of $M. Currently, Cardano is valued at % below its all time high of $ This all-. The current price of Cardano is $ per ADA. With a circulating supply of 35,,, ADA, it means that Cardano has a total market cap of. Current Cardano (ADA) token data: Price $ , Trading Volume $ M, Market Cap $ B, Circ. Supply B, Total Supply B. Official links to. The current market cap of ADA is $B. It is calculated by multiplying the current supply of ADA by its real-time market price of $B. How do I store. - ADA real-time live price is USD current market cap of $ USD. Follow Cardano price, trends and news on MEXC!

Which Banks Offer The Best Student Loans

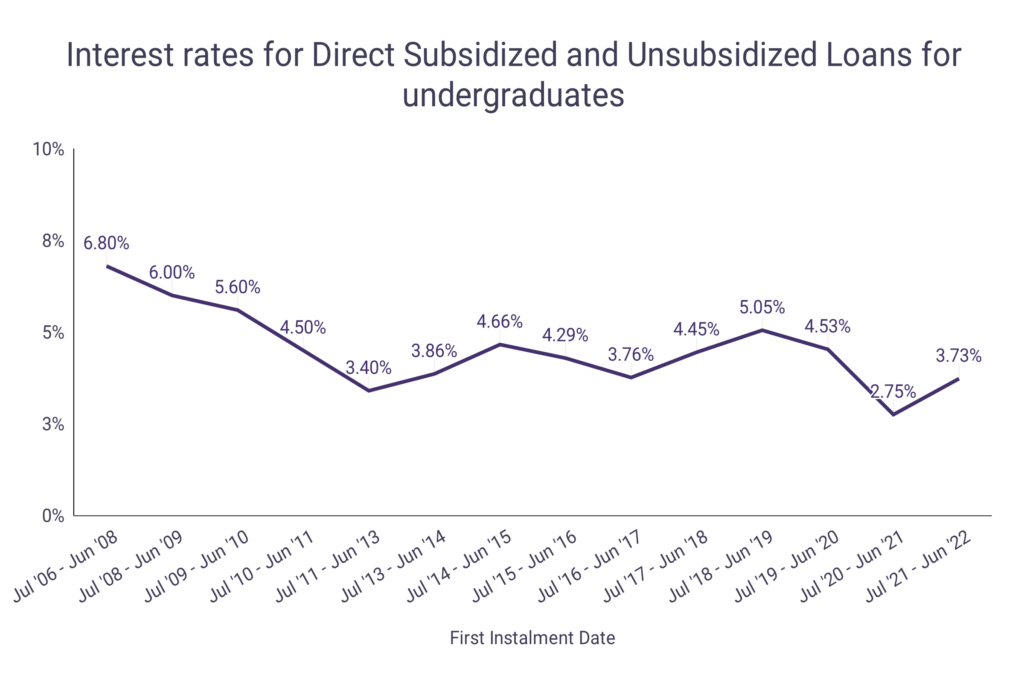

If you have a practical major that has high earning potential after, I'd say discover for private loans and federal only is obviously the best. US News named us one of the Best Loan Companies for private student loans Do you offer loans to international students? Do you offer coronavirus relief. Best from an online lender: College Ave · Best from a brick-and-mortar bank: Citizens Bank · Best for applying with a co-signer: Sallie Mae · Best for applying. American Savings Bank is proud to collaborate with College Ave Student Loans to offer simple and personal private student loan products that help parents and. SoFi Private Student Loans is a peer-to-peer lender offering private student loans for both graduate and undergraduate students. They also provide private and. Use private student loans as a last resort. These are controlled by banking institutions and offer few flexible repayment plans. Banks may offer lower. Students can choose either federal or private student loans to help pay for school. Bankrate can help you find the best student loan to fit your needs. I had two private loans from Citi Bank (Now Discover Loans) and Chase. Good experience with both. I suggest applying to at least two banks and. They often offer great interest rates, sometimes even better than regular banks. This makes them a solid choice to cover extra costs that your federal student. If you have a practical major that has high earning potential after, I'd say discover for private loans and federal only is obviously the best. US News named us one of the Best Loan Companies for private student loans Do you offer loans to international students? Do you offer coronavirus relief. Best from an online lender: College Ave · Best from a brick-and-mortar bank: Citizens Bank · Best for applying with a co-signer: Sallie Mae · Best for applying. American Savings Bank is proud to collaborate with College Ave Student Loans to offer simple and personal private student loan products that help parents and. SoFi Private Student Loans is a peer-to-peer lender offering private student loans for both graduate and undergraduate students. They also provide private and. Use private student loans as a last resort. These are controlled by banking institutions and offer few flexible repayment plans. Banks may offer lower. Students can choose either federal or private student loans to help pay for school. Bankrate can help you find the best student loan to fit your needs. I had two private loans from Citi Bank (Now Discover Loans) and Chase. Good experience with both. I suggest applying to at least two banks and. They often offer great interest rates, sometimes even better than regular banks. This makes them a solid choice to cover extra costs that your federal student.

If you prequalify, the rates and loan options offered to you are estimates only. Once you choose your loan options and submit your application, DR Bank may. Citibank · Wells Fargo · Chase · SunTrust · Sallie Mae. Private lenders offer loans for a wide variety of students, addressing a wide range of student needs. Oklahoma's Credit Union (OKCU) offers great service and rates on auto loans, home loans, certificates and other personal and business banking solutions. First Bank and Trust Company has partnered with College Ave Student Loans, a private student loan company, to provide financing options without the stress. Easy. PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future. Great Southern Bank is not the creditor for these loans and is compensated by Sallie Mae for the referral of loan customers. Applications are subject to a. No. Federal student loan interest is set by law and is artificially low. I am not aware of any commercial banks that offer student loans. Citizens Bank is also one of the few loan providers that offer student loan refinancing even if you didn't finish school. Eligibility requirements. You must be. Regions and Sallie Mae have teamed up to offer convenient financing and loan options for undegraduate and graduate students. Visit us online to learn more. With some of the lowest fixed interest rates and an autopay discount, College Ave can help save creditworthy borrowers a lot of money on their educational loans. Citizens offers student loans from $1, to $, with repayment terms from five to 15 years. If you already have an account with Citizens, you could get a. Best low-interest student loans · SoFi: Best overall. · College Ave: Best for variety of repayment options. · Sallie Mae: Best for part-time students. · MEFA: Best. Best for Graduate Students With a Co-Signer: Citizens Bank Additionally, the lender offers multi-year approval, so you don't have to submit an official. 7 of the best graduate student loan lenders ; Ascent · Options for graduate students who don't have a cosigner ; Citizens Bank · Offers high loan amounts for. SoFi offers private student loans that can cover all school-certified costs with no fees. SoFi also offers some unique benefits to borrowers. Access: Most students are eligible for federal student loans. · Lower interest rates: For most borrowers, federal loans offer lower interest rates than private. Private student loans provided by banks, credit unions, and other lenders With just a few clicks, you can view, filter and compare private student loan. College Ave offers Student Loan Refinancing for graduates. Refinancing your existing student loans can reduce your monthly payment and even the total cost of. offer graduate student loan options that are tailored to you and your ongoing education. A Parent Student Loan is a great alternative to the federal PLUS loan. Compare federal and private student loans. Select the student loan option best for you Since private student loans are offered by banks and financial.

What Is The Price Of Leaf Guard

How Much Do Gutter Guards Cost? The average cost to install gutter guards on a 2, square foot home ranges between $ and $5, The national average. Before choosing a gutter guard for your home, you need to consider the upfront costs. For a typical home, these gutter guards can cost between $2, to $7, Gutter guard installation costs typically range from $1, to $2,, but many homeowners will pay around $1, on average. Breaking this down further. Use the gutter guard to help prevent rainwater from running behind the fascia. Featuring flexible, vinyl construction for durability, this gutter guard installs. LeafFilter offers a versatile, highly effective gutter protection system. Our research shows that it provides technologically superior gutter protection, and. Wire strainers prevent leaves and other debris from clogging downspouts. To install a wire strainer, simply place the gutter strainer inside the outlet tube. The average cost of LeafGuard installation ranges between $20 and $70 per linear foot of gutter length. The price includes installation and the material costs. Each hole is 1/8" in diameter designed to handle massive rainfalls while stopping leaves and debris from entering your gutters. Our 1/8" hole diameter also. Gutter Guard Cost by Linear Foot. Depending on the type of gutter guard you choose—and the material from which it's made—you can expect to spend between $ How Much Do Gutter Guards Cost? The average cost to install gutter guards on a 2, square foot home ranges between $ and $5, The national average. Before choosing a gutter guard for your home, you need to consider the upfront costs. For a typical home, these gutter guards can cost between $2, to $7, Gutter guard installation costs typically range from $1, to $2,, but many homeowners will pay around $1, on average. Breaking this down further. Use the gutter guard to help prevent rainwater from running behind the fascia. Featuring flexible, vinyl construction for durability, this gutter guard installs. LeafFilter offers a versatile, highly effective gutter protection system. Our research shows that it provides technologically superior gutter protection, and. Wire strainers prevent leaves and other debris from clogging downspouts. To install a wire strainer, simply place the gutter strainer inside the outlet tube. The average cost of LeafGuard installation ranges between $20 and $70 per linear foot of gutter length. The price includes installation and the material costs. Each hole is 1/8" in diameter designed to handle massive rainfalls while stopping leaves and debris from entering your gutters. Our 1/8" hole diameter also. Gutter Guard Cost by Linear Foot. Depending on the type of gutter guard you choose—and the material from which it's made—you can expect to spend between $

The average price for Gutter Systems ranges from $10 to over $5, What are the shipping options for Gutter Systems? All Gutter Systems can be shipped to you. The average cost of gutter guards depends on several factors. First, you must decide whether to try and put them on yourself or call for help from a. Raindrop provides gutter protection like no other gutter guard available. Every aspect of the Raindrop Gutter Guard is essential in its goal to provide a. Typically, how much does leaf filter costs per foot range from $17 to $ The exact price depends on several factors, including the condition of your existing. Leaf guards on gutters can be effective in preventing leaves, debris, and other materials from clogging your gutters. They work by creating a. Totals - Cost To Install Rain Gutter Cover, FT, $1,, $2, ; Average Cost per Linear Foot, $, $ The national average cost for installing gutter guards is between $69 and $, with an average spend of around $ on linear feet of metal mesh covers. On. Wire strainers prevent leaves and other debris from clogging downspouts. To install a wire strainer, simply place the gutter strainer inside the outlet tube. LeafGuard's gutter guards keep most materials out of your gutters. Customer reviews indicate that it excels at blocking large debris such as leaves, twigs, roof. Our small hole design size is about 1/2 the size of any leaf guard marketed by any big Home Improvement Center. These products are easy to install. an excellent. High-quality DIY gutter guards may cost approximately $4-$5 per linear foot for materials, while professional installation of more complex systems can range. High-quality DIY gutter guards may cost approximately $4-$5 per linear foot for materials, while professional installation of more complex systems can range. On average, a full leaf guard installation can cost around $ to $ all in all. Local pros & Availability. Gutter Installation available in your area. Open. Our small hole design size is about 1/2 the size of any leaf guard marketed by any big Home Improvement Center. These products are easy to install. an excellent. Patented design breakthrough. · Ultimate Gutter Protection with maximum rain flow - Simply the best gutter guard product · Smooth, slick top surface puts foliage. LeafGuard Gutters are America's most trusted gutter system guaranteed to never clog. Say goodbye to gutter cleaning forever. Schedule a free estimate today. Vinyl gutter guards. Vinyl gutter guards are the most affordable. They are typically $1 to $3 per linear foot and are often chosen by do-it-yourselfers. Each Leaf Pro panel is 4 feet in length. Available in 8 Colors. Suggested Price $ / 4-Foot Panel. The cost for vinyl gutters and downspouts would run you roughly $$ in gutters and downspouts for a linear foot project. Patented design breakthrough. · Ultimate Gutter Protection with maximum rain flow - Simply the best gutter guard product · Smooth, slick top surface puts foliage.

Home Equity Line Of Credit Easy Approval

Better Mortgage: 7 days to close Better Mortgage has a One Day HELOC™ program allows you to apply online and get approved within 24 hours. You'll then get. Home equity lines of credit usually have better interest rates and more flexible repayment terms than any other loan type. Unlike traditional loans, funds are. Your home equity line of credit made easy. Start online. Submit your secure application online - there's no fee and no obligation, and it only takes about Home equity lines of credit often have low interest rates and a flexible borrowing structure, making them a beneficial loan for home improvement costs. Unlock your home's equity · Credit lines from $10, - $, · Borrow up to 90% of your home's equity. A Home Equity Line of Credit (HELOC) is a smart personal loan choice if you have sufficient equity in your home and good credit. 1: Complete a basic application. You can do this online, by calling or by visiting a U.S. Bank branch. A HELOC's credit line remains open until its term ends, allowing you to use it as needed as long as you make your minimum required payments. Those payments will. Applying for a HELOC with Synergy One Lending is fast and easy. Our application is fast, easy, and all online. Our application uses a soft-credit inquiry. Better Mortgage: 7 days to close Better Mortgage has a One Day HELOC™ program allows you to apply online and get approved within 24 hours. You'll then get. Home equity lines of credit usually have better interest rates and more flexible repayment terms than any other loan type. Unlike traditional loans, funds are. Your home equity line of credit made easy. Start online. Submit your secure application online - there's no fee and no obligation, and it only takes about Home equity lines of credit often have low interest rates and a flexible borrowing structure, making them a beneficial loan for home improvement costs. Unlock your home's equity · Credit lines from $10, - $, · Borrow up to 90% of your home's equity. A Home Equity Line of Credit (HELOC) is a smart personal loan choice if you have sufficient equity in your home and good credit. 1: Complete a basic application. You can do this online, by calling or by visiting a U.S. Bank branch. A HELOC's credit line remains open until its term ends, allowing you to use it as needed as long as you make your minimum required payments. Those payments will. Applying for a HELOC with Synergy One Lending is fast and easy. Our application is fast, easy, and all online. Our application uses a soft-credit inquiry.

A home equity line of credit (HELOC) represents one possible line of credit no credit check option. That's because a HELOC is secured by the home itself. In. players99.site's home equity line of credit (HELOC) is an open-end product where a minimum draw amount of seventy-five percent (75%) or hundred percent (%) of. credit line balance. calculate. You may be eligible for a HELOC. Because you have an LTV at or below 85%, you may be approved for a home equity line of credit. Easy approval up to % Loan-to-Value available*; Interest-only payment option available; Easy online application process; Overdraft protection option for any. The simplest way to turn your home equity into flexible funds. See your interest rate and credit limit in minutes, with no impact on your credit score. Introductory rate of % APR on new Home Equity Lines of Credit for 6 months then as low as % variable APR · The amount you can borrow is based on the. A HELOC is a credit line, like a credit card would offer, that uses the equity in your home as collateral! It lets you borrow funds as needed, up to a set. A home equity line of credit (HELOC) is a credit line secured by the value of your home, minus any existing mortgage owed. You can borrow against it, spend. Our Home Equity Line of Credit allows you to tap into your home's equity to finance just about anything. Add a room, send your child to college, take your. HELOCs allow for quick access to the funds from your home's equity. Pay for home improvements, school, a car, etc with this flexible line of credit. How our quick and easy HELOC compares · 1 Certainty Home Lending home equity line of credit (HELOC) is an open-end product where the full loan amount (minus the. You can typically borrow up to 85% of the value of your home minus the amount you owe. Also, a lender generally looks at your credit score and history. Applying for a home equity loan can be a lengthy process and approval is not guaranteed. Lenders will thoroughly review your financial health to determine. A Home Equity Line of Credit from FNB is a credit line that helps you access the equity in your home to provide a reusable source of financing. To qualify for a HELOC, you need to meet the requirements set by the lender. Lenders typically look at your home equity, your loan-to-value ratio, your debt-to. All loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, and credit usage and. Some lenders specialize in providing loans to people with bad credit, including home equity loans. These may have higher interest rates than those for. If you have a low credit score, it may be hard to get a home equity loan. Use this guide to improve your chances of getting the loan you need. Use a Home Equity Line of Credit to renovate your home, refinance your mortgage, or consolidate debt. Need to borrow a specific amount for a repair and want to consolidate debt into one, simple payment? Like your original home mortgage, a HELOAN allows you to.

Short Term Capital Gains Tax Crypto

Short-term gains (held gains (held >1 year) at 0%, 15%, or 20%. Crypto losses can offset gains and reduce tax liability. Since Adam held the three Bitcoins for more than year, his gain would be subject to the more preferential long-term capital gains tax rate. short-term. You'll pay short-term Capital Gains Tax on crypto held for under a year and long-term Capital Gains Tax on crypto you've held for more than a year. Selling. What is capital gains income? What are short- and long-term capital gains? When a taxpayer sells a capital asset, such as stocks, a home, or business assets. If you have owned cryptocurrency for less than one year before selling or spending it, the gains are considered short-term capital gains and taxed at your. tax purposes. Other Income from Investment Partnerships. Gains and losses (short-term capital gains, long-term capital gains, IRC § , IRC § , IRC. If you owned it for days or less, you would pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, you would pay long-term. The tax rate you will be paying is the short-term Capital Gains rate. This is identical to the tax rate you pay on ordinary income, and varies based on the. Short-term capital gains are added to your income and taxed at your ordinary income tax rate. What are long-term capital gains? If you held a particular. Short-term gains (held gains (held >1 year) at 0%, 15%, or 20%. Crypto losses can offset gains and reduce tax liability. Since Adam held the three Bitcoins for more than year, his gain would be subject to the more preferential long-term capital gains tax rate. short-term. You'll pay short-term Capital Gains Tax on crypto held for under a year and long-term Capital Gains Tax on crypto you've held for more than a year. Selling. What is capital gains income? What are short- and long-term capital gains? When a taxpayer sells a capital asset, such as stocks, a home, or business assets. If you have owned cryptocurrency for less than one year before selling or spending it, the gains are considered short-term capital gains and taxed at your. tax purposes. Other Income from Investment Partnerships. Gains and losses (short-term capital gains, long-term capital gains, IRC § , IRC § , IRC. If you owned it for days or less, you would pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, you would pay long-term. The tax rate you will be paying is the short-term Capital Gains rate. This is identical to the tax rate you pay on ordinary income, and varies based on the. Short-term capital gains are added to your income and taxed at your ordinary income tax rate. What are long-term capital gains? If you held a particular.

tax return and should be included in your Washington capital gains calculation. Can I use short-term losses to offset my long-term capital gains? No. Short-term. The IRS treats cryptocurrency as property for tax purposes. · Holding cryptocurrencies for less than a year may result in short-term capital gains tax, while. Short-Term Capital Gains Tax. Currently, the IRS views cryptocurrency as an asset and not cash. So, crypto gains from sales isn't seen as income but as a. tax return on taxable investments. Sophisticated investors often utilize this strategy to offset short-term capital gains, which are taxed as ordinary. Short-term gains can happen when you sell or otherwise dispose of your crypto after holding it for less than one year. No, crypto gains are treated like selling stock or another asset. You can offset your gainis by selling something else at a 20K loss. Aside from. This short-term tax rate can range from 10% to 37% depending on your personal situation (e.g.,total taxable income, filing status etc.). Spot trading taxes. Long-Term vs. Short-Term Capital Gains for Crypto. The IRS taxes capital assets differently depending on how long you owned them. If you owned your. You have to pay taxes on any realized gains. That is when you SELL. If your just hold and values goes up then you do not pay taxes on that, only. On a gross basis, we estimate Biden's FY budget would increase taxes by about $ trillion over that period. After taking various credits into account. You'll pay 0% to 20% tax on long-term Bitcoin capital gains and 10% to 37% tax on short-term Bitcoin capital gains and income, depending on how much you earn. For example, if you bought 1 BTC at $6, and sold it at $8, three months later, you'd owe taxes on the $2, gain at the short-term capital gains tax rate. If you held the virtual currency for one year or less before selling or exchanging the virtual currency, then you will have a short-term capital gain or loss. Since you held the 1 BTC for less than one year it would be considered a short-term capital gain and you'd have to pay taxes at the applicable ordinary income. The capital gains are taxed depending on the length of ownership. If you own the crypto less than 12 months before you sell it, it will be considered short term. You sold your crypto for a profit. Positions held for a year or less are taxed as short-term capital gains. · You exchanged one cryptocurrency for another. Say. Crypto taxes and capital gains. Certain Investments held for a year or less are taxed as short- term capital gain or loss, and anything held for over a. What is the tax rate on cryptocurrency? · Ordinary income rates are between 10% and 37% depending on your income tax bracket. · Short-term capital gain rates are. Even though it might seem as though you use cryptocurrency for your personal use, it is considered a capital asset by the IRS. When reporting gains on the sale. You have to pay taxes on any realized gains. That is when you SELL. If your just hold and values goes up then you do not pay taxes on that, only.

Average Signature Loan Interest Rate

Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Approximate Payment Calculation Table ; Product, As Low As Rate, Term ; Signature Loan, %, 60 ; Signature Line of Credit, %, 60 ; Savings Secured (Regular. The average personal loan interest rate is %. That's based on four weeks of data from 18 lenders and the rates they quoted to approximately , Perks include: Boosts credit score by 60 points on average Increases savings balance by $ on average A fixed, low interest rate of % APR. Category: Interest Rates > Personal Loan Rates, 1 economic data series, FRED: Download, graph, and track economic data. Max Loan Limit. $50, Max Term Limit. 96 Mths. Application Fee. $0. Calculate Your Loan Payment. Loan amount ($). Annual interest rate (0% to 40%). Term of. What is a good personal loan interest rate? · and above: Below 8% (look for loans for excellent credit) · to Around 14% (look for loans for good. Experian put the average personal loan annual percentage rate (APR) at % in , while the New York Federal Reserve puts the average personal loan interest. Signature loan rates ; +, % ; , % ; , % ; , %. Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up to $ Approximate Payment Calculation Table ; Product, As Low As Rate, Term ; Signature Loan, %, 60 ; Signature Line of Credit, %, 60 ; Savings Secured (Regular. The average personal loan interest rate is %. That's based on four weeks of data from 18 lenders and the rates they quoted to approximately , Perks include: Boosts credit score by 60 points on average Increases savings balance by $ on average A fixed, low interest rate of % APR. Category: Interest Rates > Personal Loan Rates, 1 economic data series, FRED: Download, graph, and track economic data. Max Loan Limit. $50, Max Term Limit. 96 Mths. Application Fee. $0. Calculate Your Loan Payment. Loan amount ($). Annual interest rate (0% to 40%). Term of. What is a good personal loan interest rate? · and above: Below 8% (look for loans for excellent credit) · to Around 14% (look for loans for good. Experian put the average personal loan annual percentage rate (APR) at % in , while the New York Federal Reserve puts the average personal loan interest. Signature loan rates ; +, % ; , % ; , % ; , %.

Personal loan interest rates as low as % APR 1, 2 APR includes a % relationship discount.

Personal loan features. Terms up to 5 years²; Personal loan interest rates as low as % APR; No application fees; No collateral required. Today's Rate. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. Flexible terms and competitive rates make this personal loan a great way to achieve your goals. Draw funds as needed at a variable interest rate; Unsecured —. Signature Loans are designed to let you use the loan at your discretion. Apply easily online. Average personal loan rates* on 3-year loans were at % APR, up from % last week and from % a year ago. · Average personal loan rates* on 5-year. The following examples depict the APR, monthly payment and total payments during the life of a $30, personal loan. All personal loan APR rates below are. Personal Loan rates range from % to % players99.sitet Example: A loan amount of $5, for 36 months has a payment range from $ to $ and finance. For example, a borrower received a signature loan with a 5% interest rate for an amount that equals the total debt on all their credit cards, with rates ranging. Save on interest with a fixed interest rate from % - % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. LightStream Personal Loans · Annual Percentage Rate (APR). % - %* APR with AutoPay · Loan purpose. Debt consolidation, home improvement, auto financing. Personal loan interest rates are expressed as a percentage of the amount you borrow. · Most personal loans are unsecured—that is, not backed up by a recoverable. In , the average personal loan interest rate fluctuated. By June, it was %. The rate you pay will depend on the lender and your credit score. And. Signature Loan Variable Rate, 60 months, %, $, Receive a notification when this rate changesReceive a notification when this rate changes. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. FICO scores of to have a maximum term of 60 months, below maximum term is 60 months. Payment Example: Financing $25, at % for 60 months. Interest rates as low as % APR. Up to $30, in one lump sum. Funds are typically available the same day or next business day after approval. Flexible. Loan Rates ; Visa Platinum · , % Introductory APR on purchases and balance transfers made during the first days; rate effective first 12 months card. Loan Rates ; $1,, $25,, % () Daily Index, % of outstanding balance or $10, whichever is greater.